Our Services

We Provides Quality Service in the Areas of Income Tax Return Filing, GST Returns Filing, Auditing, Accounting, Company Law Matters, Management Consultancy.

We Provides Quality Service in the Areas of Income Tax Return Filing, GST Returns Filing, Auditing, Accounting, Company Law Matters, Management Consultancy.

File Your ITR In Four Simple Steps

Simple, Transsparent And Great ITR Plans.

We are one of the India s best Tax and Business Consultant having the efficient Team of Chartered Accountant, Company Secretary and other professionals. We are here to assist filing of Income Tax Returns with accuracy and efficiency. We also provide the consultancy in the area of TDS, GST, Company Registration, Roc Compliances and many other legal and professional services. Connect with us for one stop complete Solution.

Learn More

Our Philosophy is simple; Hire Great People and give them the resources and support to do their best work.

We appreciate feedback from our customers

We value your feedback, queries, and suggestions. Our customer support team is here to assist you. Feel free to reach out to us using the contact details provided below:

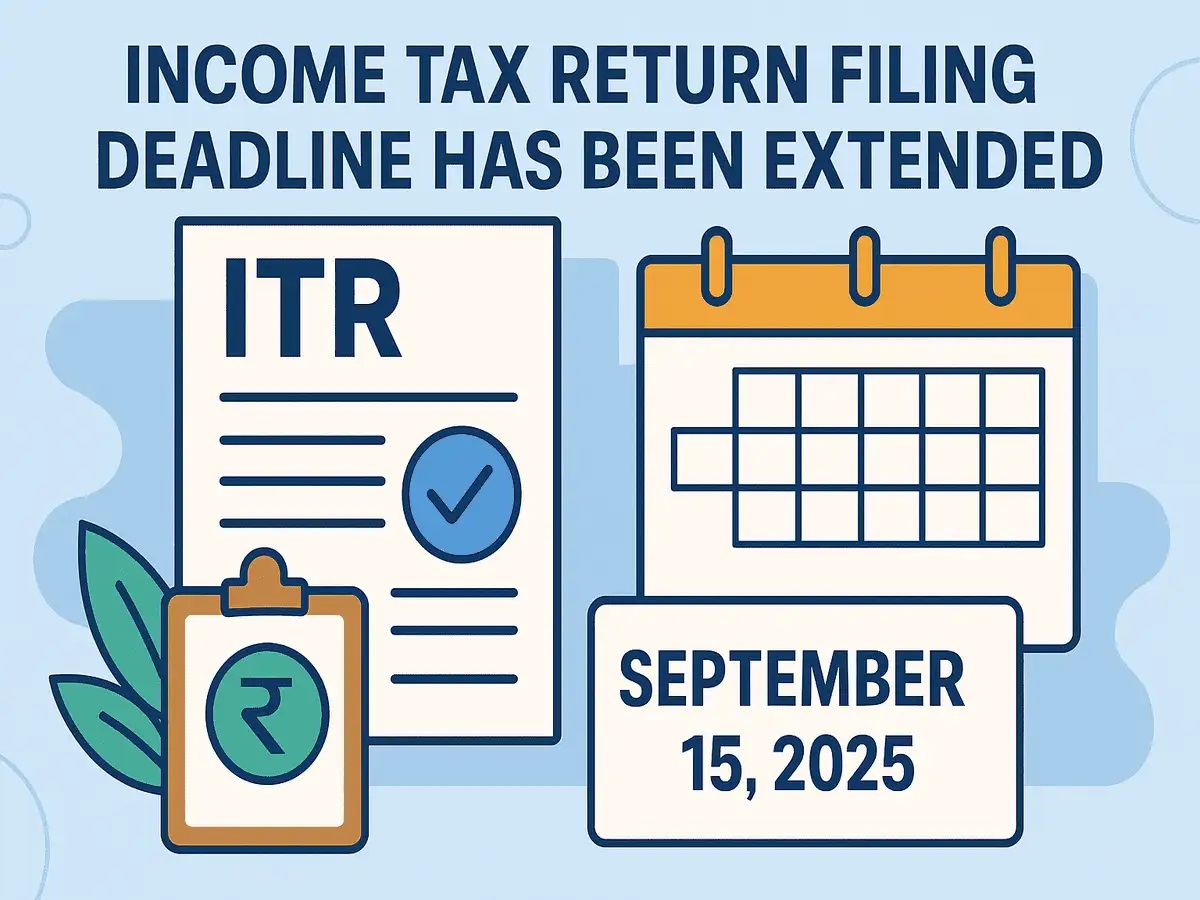

Never miss a beat in the world of taxation. Our blog delivers timely updates on policy changes, filing deadlines, and emerging trends, ensuring you're always informed and prepared.